Even though a significant majority of technology purchases are made by businesses, the consumer is rapidly gaining a meaningful position in the market. According to Gartner, in 2010 businesses will drive 72% of technology purchases. The iPhone/iPad revolution is largely driven by consumer purchases. As these devices are introduced into the enterprise computing environment, IT professionals are developing strategies for managing them. Forward thinking technology marketing people are presently working to understand how these changes will impact IT purchasing decisions in the enterprise.

Here we examine the arc of this revolution and make an attempt to help marketers position themselves for the evolved technology marketplace.

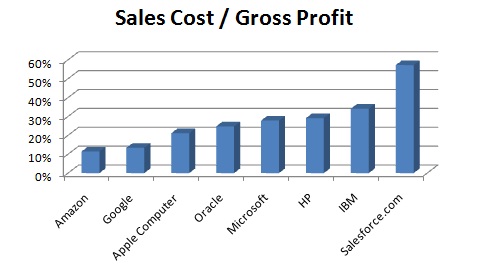

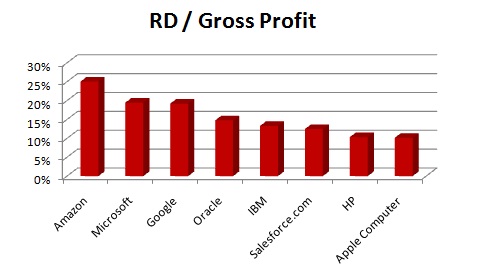

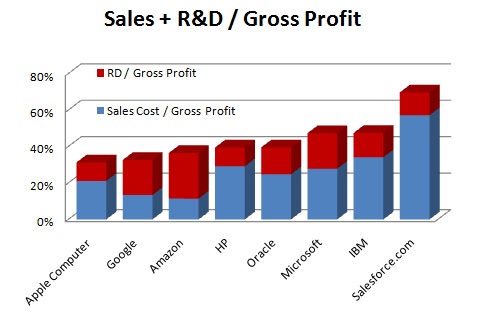

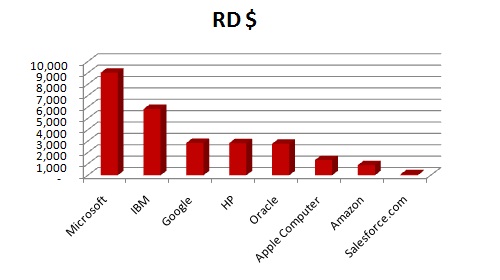

The Cost of Selling is High for the Enterprise and Low for the Consumer

Maybe it is cheap to sell to the consumer because consumer products are cheap, or maybe consumer products can be offered cheaply because it is cheap to sell them. Either way, it costs much less to sell to the consumer than the enterprise, and in some cases the cost of customer acquisition is approaching zero. Alternatively, over on the enterprise end of the spectrum, we find companies like Salesforce.com – whose largest expense is for customer acquisition. For 10 years SFDC has spent over 50% of their gross margin on sales and marketing – and this year they will spend over $700 million. Ten times as much as it will cost them to deliver their services. Right behind Salesforce.com are Oracle, IBM, HP and Microsoft each spending over 20% of their gross margin on Sales and Marketing.

When it comes to selling the approaches cannot be more different, consumer companies like Google sell by getting their customers to act as their own salespeople (filling out a form on the web), quite a contrast to Salesforce.com and the others who are seeking business customers by blanketing the earth with salespeople and partners.

Getting to Market: To Advertise or Not To Advertise

Even companies with buckets of money must select a go to market strategy and concentrate their resources in what they believe are high value activities. There are as many opinions about which strategy works best as there are CMOs – but just about all CMOS will agree that resources must be concentrated in high value activities consistent with their strategy. Anyone spreading their resources thinly over too many activities is doomed. The decision tree starts with advertising. There are companies like Apple and Dell that go big on advertising and PR and companies like Microsoft and HP that invest their resources in building partner ecosystems. A completely different third approach is lowering prices so far that solutions sell themselves. Google and Craigslist price their services at 1/10th of their offline competitors. Prices this low promote themselves – a $3,000 car or a $1 movie ticket would not require advertising or salespeople – the newspapers would write about it and the message would spread virally.

Let Someone Else to Pay

There is no charge for using a search engine or web service like Twitter or Facebook. Using a free product does not make you a customer however. The customers of these companies are the advertisers, and their payments for advertisements make it possible for companies like Google, Twitter and Facebook to offer valuable services for no charge to those benefiting from them. No monetary charge would be a little more accurate. The truth is: those not paying for a service are not the customer, they (or their data) are the product being sold to someone else. This is where the gulf between consumer and enterprise gets interesting. Individuals are much more willing to give up their data in exchange for a free service. Enterprise data is almost always a strategic asset and therefore most businesses are reluctant to trade their data for services. Salesforce.com’s clients are businesses and they pay for the service because giving up their data to be sold to a third party would undermine their viability. Google gets right up to the line on this one because they are selling the data they have about their customers to third parties – and many of their customers are businesses. Admittedly Google is not going to one client and saying they will sell the content of another client’s searches or emails. They will however allow one client to present advertisements to a targeted audience that is likely to include its competitor’s customers or employees. This is evidence that the gap between consumer and enterprise buying habits is closing.

Mixing it up: Put the Blender on Whip

Twenty years ago, with the exception of a few intrepid door to door salespeople, the consumer went to the store and salespeople called on businesses. Then Amazon.com brought the store to the consumer’s home, and Dell cut out the salesperson by giving businesses the ability to serve as their own salespeople over the phone and web. The consumer and business buyers including those in the technology market had been oil and water, and they were about to get poured into the blender. When the first killer app for the consumer oriented Mac turned out to be the business oriented use case of desktop publishing – it was like hitting the chop button on the blender. Employees connecting their home computers to corporate networks, enabled largely by broadband deployment, was the equivalent of the stir button. Social media tools like MySpace, Friendster, LinkedIn, Facebook, and Twitter turned the blender up to puree. And as we are learning in our one question survey this month, the iPhone and iPad have cranked the margarita making machine up to whip and the water and oil have emerged as thick as chocolate mousse. With consumer tech and enterprise tech all whipped up together, selling technology now takes on a combination of enterprise selling and consumer selling tactics.

Enterprise Marketing Must Change

Right now there is a great deal of energy being invested by enterprise marketing people in social media. This is important, but not the only area where the enterprise / consumer collision is impacting the market. We will never know if the big brains at Apple developed their iPhone/iPad strategy with an eye on the enterprise market. Intentional or not, their shiny new devices are changing the marketplace and buying patterns significantly. Starbucks is moving to HTML 5 and away from dot net as a result. Flash is being marginalized. And products like those from Parallels that tie the new environment together, are ramping fast. Enterprise marketers need to free their minds from a focus on making the things they have always done more efficient and start experimenting to develop new strategies that are effective in this new marketplace.

On the Horizon

As participants in technology marketing for the enterprise, these are the trends we expect to see accelerate as a result of the blending of the consumer and enterprise markets:

Social Media: Clearly social media will be central to these changes, both driving and being driven by the marketplace evolution. The key to social media is authenticity. They key to authenticity is flexibility and IQ. Companies with intelligent and autonomous actors on social media platforms will win. It does not hurt that the highest value customers are the early adopters of social media. 100 years ago, when telephones had been deployed in 10% of the households, companies realized that the early adopters of the telephone were on the high end of the socio-economic ladder and should be treated as such. Once telephones achieved 98% penetration, and the overwhelming majority of phone calls came from average customers, companies shifted their approach from high investment in high value customers to cost containment. This is why a Comcast customer can get a high quality response from @comcastcares, and not from the Comcast call center. Comcast knows the demographics of their social media savvy customers. It will be some time before social media is democratized. To Do: Get smart people into the social media game.

Computer Operators: Before the computerization of the telco central office, switching was done by telephone operators. An operator could manage approximately 200 telephone lines. We now have 180 million land lines and over 200 million mobile lines in the US. If we had to rely on manual switching – we would now require 1.9 million telephone operators. Thanks to automation we only have 22,000 telephone operators now and none of them are switching calls. In the early days of the computer an operator with significant training was required to run the device. This continued during the early days of the PC. The devices were complicated enough that every user was essentially a trained computer operator. It has only been in the last 10 years that computers could be operated without the barrier of significant training. The iPhone and the iPad are revolutionary in that they require no specific training at all. A child can pick one up and figure out how to use it. Many businesses now operate without a single IT resource on staff. Computer operators are not dead however, they have shifted to managed IT service providers, web service operators, and application developers. This trend will continue to accelerate. Business will be less technically aware and will purchase services from specialized service providers. The service providers will have all of the computer operators and accordingly will increase in sophistication and technical capabilities. This will split the marketplace into the sellers of the services and the sellers of the underlying technology. The services will be purchased by people with business needs and a low level of technical sophistication. The underlying technology will be purchased by people with an extremely high level of technical sophistication. To Do: Market services by business use case and technology by engineering merit.

Partners Migrate to Service Sales: The bifurcation of technology into unsophisticated (technically that is) buyers of services and very sophisticated buyers of the underlying technology will force a split in sales and marketing strategy. The big technical deals will get bigger and will be increasingly sold using internal salespeople. This will shrink the high end of enterprise technology sales and marketing done through partnerships. Who is going to sell servers to Amazon.com? IBM, Dell, HP, and others will be competing for that deal directly. Who is going to sell desktops to the law firm? Channel partners. Historically those partners have been companies. Of course because partnerships are relationships, and relationships are between actual people, the reality has always been that the success of these partnerships depend heavily on the relationships between the people inside the companies. For fifty years, people have been getting more and more mobile, a trend that has been accelerated by the latest economic challenges, and facilitated by social media tools. Technology companies that are able to shift their thinking from partnering with companies to partnering with people will jump well ahead during this transition. To Do: Orient partner programs to individual people that sell services.

In the years ahead businesses will remain the most significant source of revenue in the technology industry. Businesses will however increasingly behave like consumers when purchasing service offerings. They will be looking for cost effective solutions to their most pressing needs, and they will be buying those solutions on short lead times and with relatively low technical sophistication. Vendors and solution providers that position themselves for this change will win in the transition.